The Reserve Bank of Australia (RBA) voted to raise its benchmark interest rate by 0.25 points on May 3, 2021, more than 11 years after its last rate increase. The mortgage market needs to brace for a flurry of re-mortgaging as homeowners reassess their loans and the level of mortgage stress they can expect, even as overall new lending moderates.

Any time there is a shift in interest rates from the RBA, we can expect a response from the property and mortgage market. In the past, rate increases have resulted in an uptick in fixed-rate mortgages and there is no reason not to expect a similar trend in 2022. By May the 4th, 2022, all of the country’s big four banks had announced they were passing on the rate increase to customers. The expectation of further rate increases will put a dampener on the property market itself. Of course, the pandemic has upended many past trends, so it is useful to revisit our usual assumptions about market impacts. To do so, we can look to the New Zealand and UK mortgage markets.

Total gross advances will decline, led by investment property mortgages

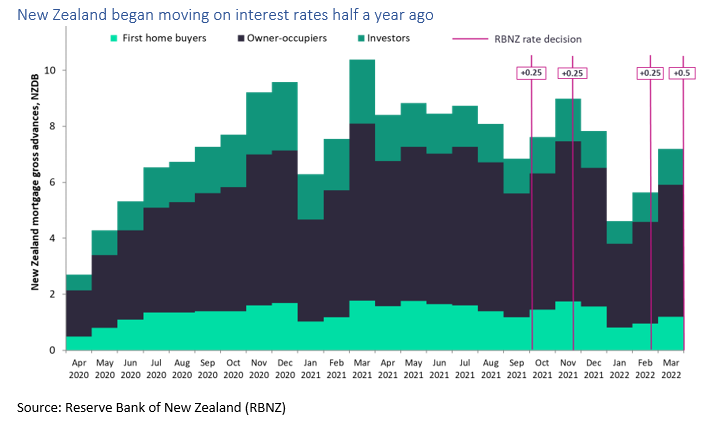

Raising the cost of mortgages will inevitably reduce demand for the product, and data suggests the impact is quick. New Zealand began raising rates at the start of October 2021, increasing 0.25 points to 0.5%. While monthly gross advances declined modestly in October 2021 (-1.1%), loans for investment property declined by 30.6% compared to the business volumes a year prior in October 2020. Investors are often more rate sensitive and quick to move in and out of the market. Since the first rate increase in October, investment property loans have been leading the contraction in overall new loans compared to the same month a year prior.

GlobalData expects a similar reaction in the Australian market. With investors being the strongest growth segment for the Australian mortgage market in 2021, this could severely alter overall market growth for 2022.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataRefinance underpins much new business in the owner-occupier space

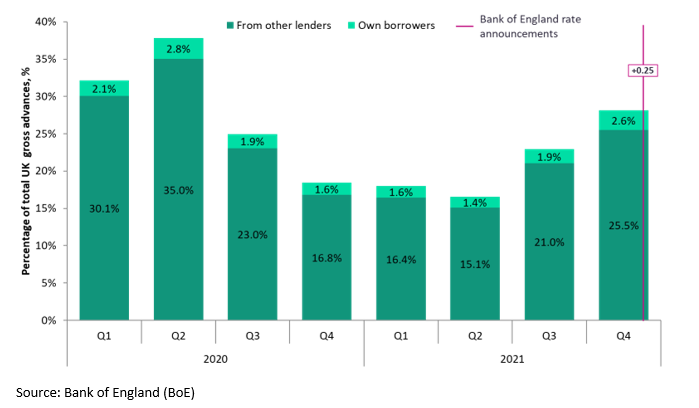

One of the interesting trends evident from New Zealand data is that the owner-occupier market holds up better in the face of rate increases. The owner-occupier market (both first-time buyers and existing homeowners) did not begin to decline until December 2021, after the second rate increase. GlobalData attributes much of this to a greater amount of refinancing. For this insight we look to the UK market, where the Bank of England (BoE) has increased its rates three times since December 2021. This widely anticipated move is likely to have shaped behavior months prior.

Here we can see the market behaving in classic style, with refinancing picking up towards the end of 2021, mostly driven by refinancing with another lender. Essentially, consumer were incentivized to get out and find better rates before the start of the rate increases. Preliminary data from industry executives suggests this continued into Q1 2022. Australian lenders need to anticipate similar churn in the market and aim to capture the scramble to lock in low rates.

Lenders looking to grow their mortgage book need to cut out the pain points

While some homeowners will have already thought ahead and locked in historically low rates, many will be seeking out a new deal over the next six months. Every rate increase will put more pressure on these homeowners to find a deal quickly. Lenders looking to capitalize need to make sure they are able to act with speed. In 2021, our Financial Services Consumer Survey found 14% of all mortgage holders cited the convenience of the mortgage process as to why they choose their provider, with 19% of first home buyers citing this.

Once again, investments in straight-through processing and quick decisioning regarding a loan offer are critical to success. Those providers can lock in deals before the next rate meeting in June 2022 will have an advantage in a market that is moving fast. Speed in processing mortgage applications can mean the difference in hundreds, possibly thousands of dollars in extra interest of the year.

Andrew Haslip is Head of Content for Wealth Management and Asia Pacific (FS), GlobalData