UK regulator the Financial Conduct Authority (FCA) has found evidence of growing competition in the UK banking sector. Its 2022 Strategic Review of Retail Banking Business Models concluded that despite the historic advantages of incumbent banks, a shift in market share is beginning to become noticeable. Increased innovation and digitisation are changing consumer behaviours, which in turn is boosting consumers’ preference for alternative providers.

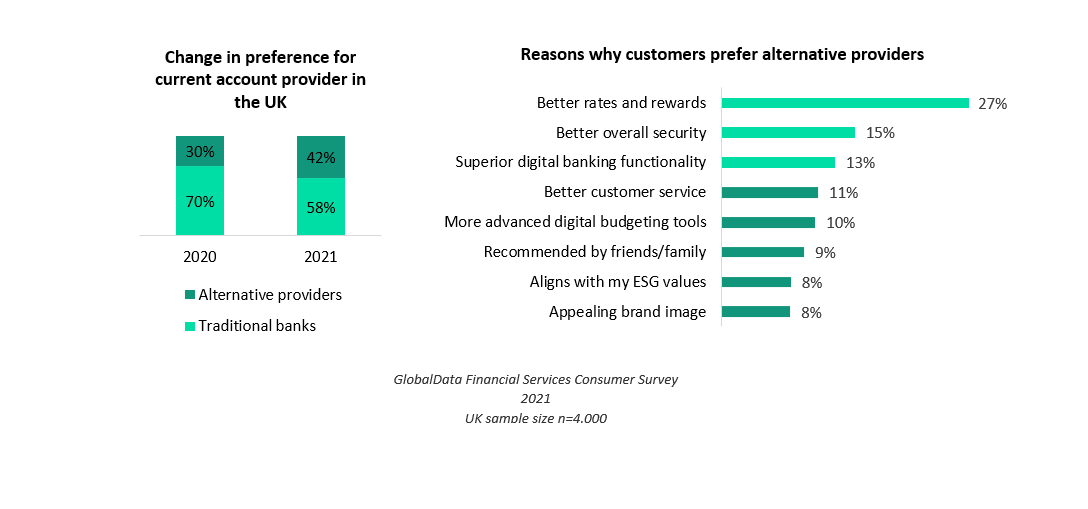

According to the FCA, the share of current accounts held by digital challengers rose by 2 percentage points between 2020 and 2021. As a result, digital challengers now account for 8% of personal current accounts in the UK. Meanwhile, the UK’s big four (Lloyds, Barclays, HSBC, and NatWest) saw their share fall marginally. The same trend was highlighted by GlobalData’s 2021 Financial Services Consumer Survey, which noted a 12 percentage point change in preference for alternative providers in the UK at the expense of incumbents, with a 1 percentage point increase in preference for digital-only banks specifically. The most cited reasons for preferring alternative providers are the belief they offer better rates and rewards, better overall security, and superior digital banking functionality.

GlobalData Financial Services Consumer Survey 2021

UK sample size n=4,000

The preference for fintech platforms and digital-only banks was accelerated in the UK (and around the world) by the COVID-19 pandemic. Practically all banking services went online as branch networks closed or began to operate on a reduced-hours basis. Use of digital channels has made factors such as ease of digital banking and advanced digital banking functionality the most important elements of service to customers – particularly as digital habits persist post-pandemic.

Consequently, attitudes towards financial services disruptors are changing. Trust and reputation are becoming less important, while demand for innovative platforms that serve multiple functions will only increase with the rise of super apps on the horizon.

In Q3 2021, Nationwide had the largest net switching gain (+33,828), followed by digital challengers Starling (+15,371) and Monzo (+6,498). The Current Account Switch Service reported that the most frequently cited reasons for switching were better online banking facilities (51%) and better mobile banking apps (41%) – a sign that competition between incumbents and challengers is only set to increase as both sides emulate key characteristics of the other.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataThe FCA’s report also highlighted that the difference in profitability between large banks and smaller challengers has reduced in recent years. Margins across products for larger banks have been decreasing, while the introduction of new banking services has created new revenue streams for alternative providers.

This was written by Mohammed Hasan, Banking Analyst, GlobalData