Globally, the digital banking space is being increasingly defined by the rise of digital incumbents such as Marcus, Chase, and Ubank. Having the backing of a traditional player offers a level of security that digital challengers can only dream of. However, they will still face similar challenges in terms of balancing customer acquisition and profitability.

Marcus by Goldman Sachs and Chase by JPMorgan Chase have racked up deposits at an astronomical rate in the UK and the US. In Hong Kong (China SAR), a new wave of digital banks is being spearheaded by the likes of Mox by Standard Chartered, as well as apps backed by big telecom companies and investment banks. Meanwhile, Australia has been ahead of the curve with regards to this trend. Digital challengers Xinja and Volt collapsed in 2020 and 2022 respectively. To avoid a similar fate, 86 400 was absorbed by digital incumbent Ubank (a subsidiary of National Australia Bank [NAB]). Of the two digital banks that remain in the country, Ubank is owned by NAB while Up is partnered with Bendigo Bank.

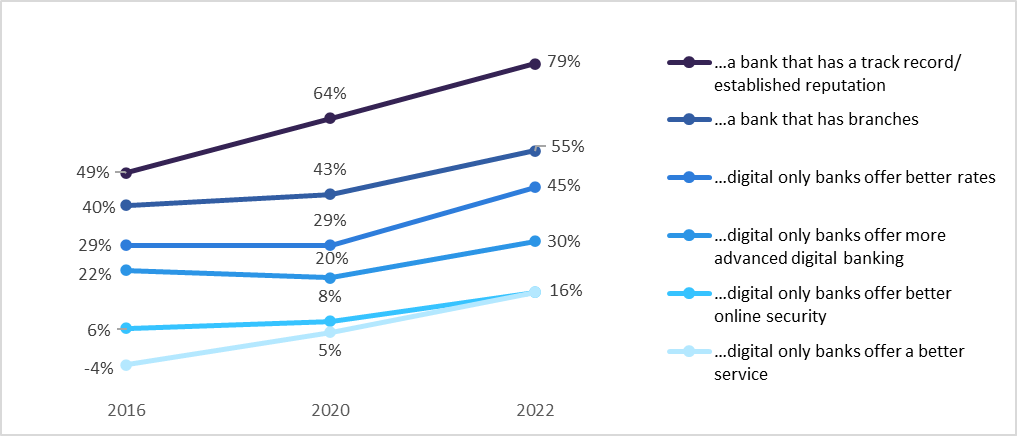

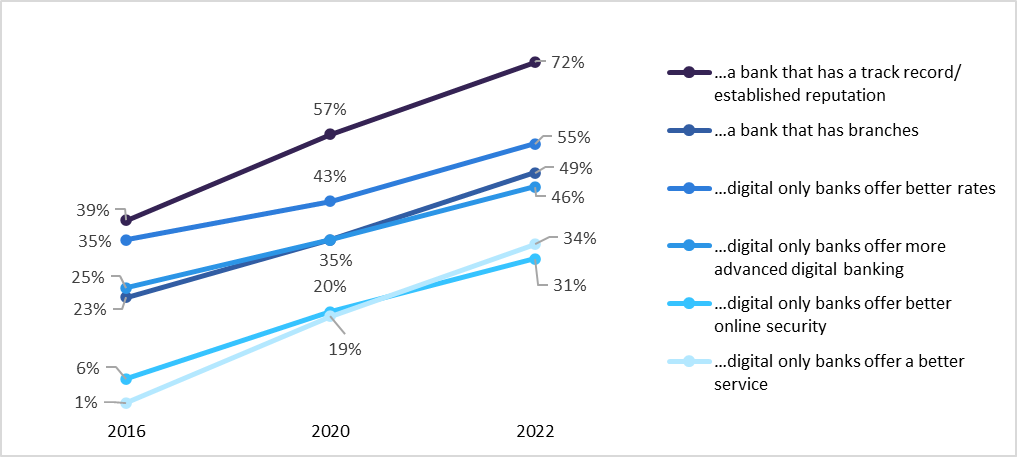

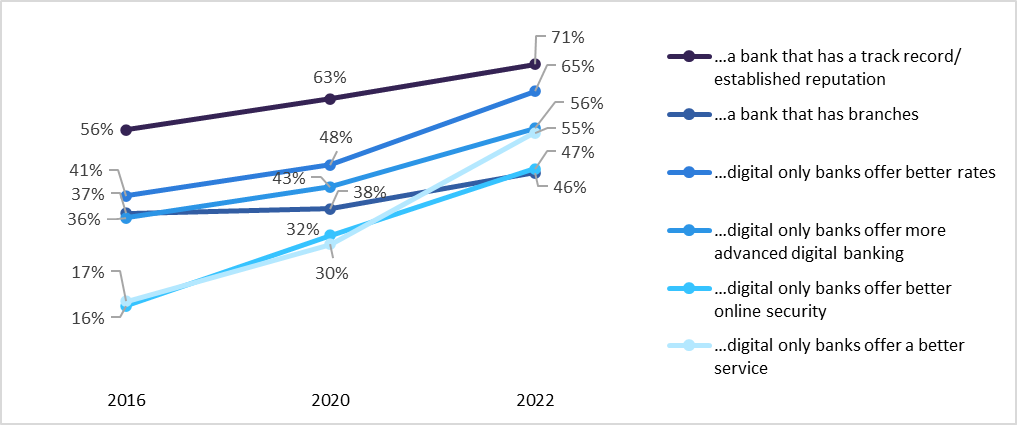

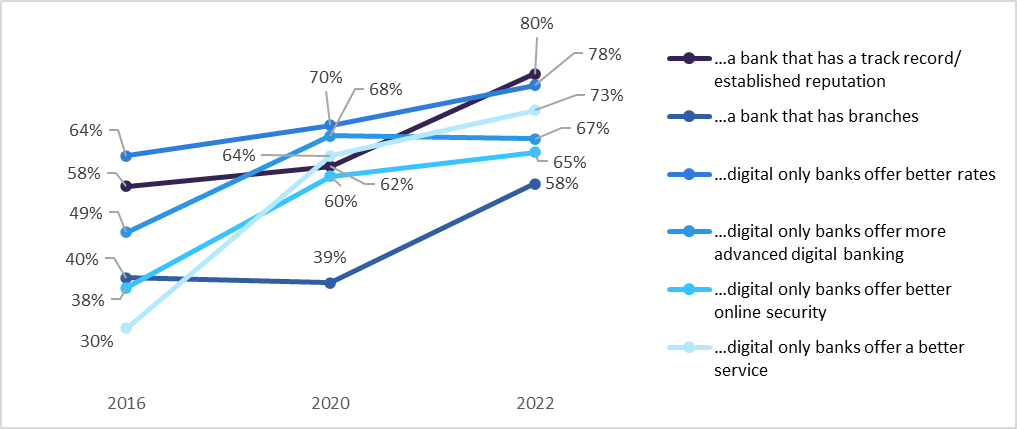

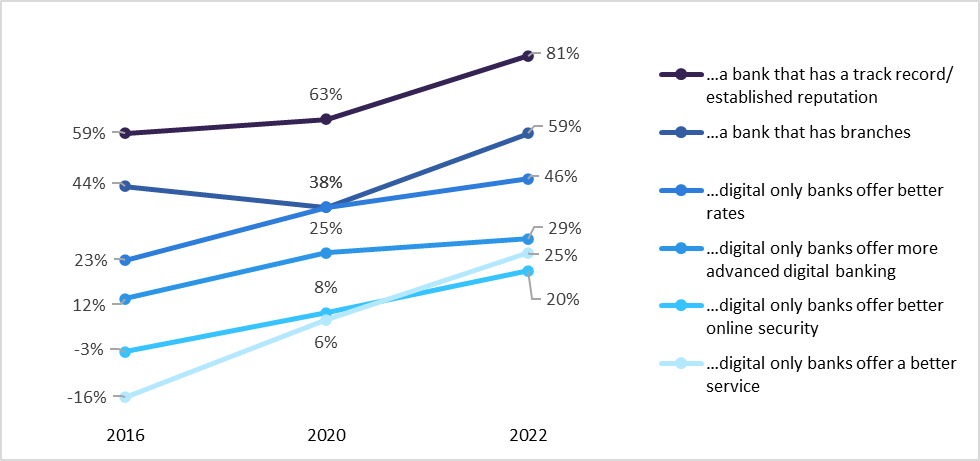

Looking at consumer attitudes over time some clear trends emerge, regardless of market. Consumers view digital banks favourably, while the extent to which they do so has been growing over time. However, alongside this has been a more than commensurate increase in people’s preference for banks with branches and an established reputation. So while the success of digital challengers suggests that consumers desire an alternative to traditional banks, GlobalData’s 2022 Financial Services Consumer Survey suggests otherwise. Consumers do not want to move beyond traditional banks – they just want these banks to offer services of the same quality as digital challengers. Digital incumbents therefore should not be afraid to boast of their connections to traditional banks.

Moreover, although they are not taking advantage of this yet, connecting their services to their parent bank’s branch network would satisfy an unmet customer demand – something digital challengers lack the ability to do. Overall, the customer acquisition potential of digital incumbents is not to be understated.

Digital incumbents: the big issue is profitability

However, digital incumbents should be wary that although customer acquisition is important it can also be dangerous. Indeed, many digital banks have found customer acquisition easy in comparison to traditional providers. The biggest issue has instead been profitability. Even neobanks that are ostensibly the “most successful” remain unprofitable. Nubank, Revolut, and Monzo stand as prime examples of this fact. Xinja collapsed partly because it was so successful at attracting new customers, having failed to monetize its products effectively. Considering the customer acquisition potential of digital banks, digital incumbents banks should consider slowing their rate of acquisition by only allowing referrals at first (as Nubank did) to make sure that average cost per customer does not massively exceed average revenue per customer.

The few banks that have reached profitability have done so by immediately focusing on creating a monetizable product portfolio. Although unique for its connection to the messaging platform KakaoTalk, KakaoBank planned out its products extensively with consulting agency EY prior to launch. It chose to take a balance sheet approach (as opposed to a payments-based approach), generating revenue from interest charged on a range of credit instruments designed to target specific customer segments. Similarly, Starling Bank’s profitability was built on the back of a balance sheet approach, including the acquisition of mortgage lender Fleet Mortgages and offering SME loans. Digital incumbents entering the market should take note: a patient, balance sheet-based revenue strategy from the start is the best way to avoid a Xinja-type collapse in the face of rapid customer acquisition.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData

UK |

EEA |

Americas |

Asia-Pacific |

Australia |

I believe/prefer… |

UK: 2016 n=4,474, 2020 n=4,974, 2022 n =4,974

European Economic Area (EEA): 2016 n=7,701, 2020 n=10,188, 2022 n=8,204

Americas: 2016 n=3,950, 2020 n=6,878, 2022 n=6,670

Asia-Pacific: 2016 n=4,474, 2020 n=10,175, 2022 n=18,782

Australia: 2016 n=1,001, 2020 n =3,824, 2022 n= 4,000

Source: GlobalData’s 2016, 2020, and 2022 Financial Services Consumer Surveys