Switzerland’s reputation as a magnet for ultra-high-net-worth (UHNW) individuals may soon be under threat. A proposed nationwide 50% inheritance tax aimed at estates over CHF50m ($55m) will be put to a referendum among the population. The measure aims to address wealth inequality and fund pensions. However, its long-term implications could significantly erode Switzerland’s appeal as a safe haven for the world’s wealthiest families, thus creating concern among international wealth managers and private banks.

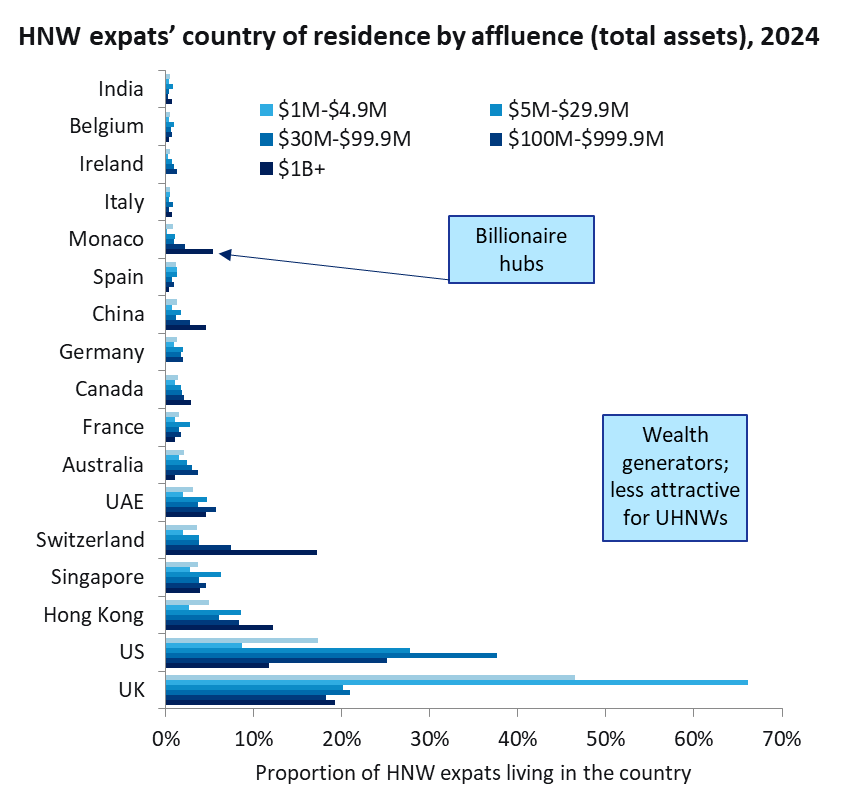

Switzerland has long enjoyed a privileged position among the global elite. It ranks fifth globally for billionaire expat residency, with 17.1% of the world’s mobile billionaires calling it home—behind only the UK, the US, Hong Kong (China SAR), and Singapore. The country’s appeal lies in its political neutrality, strong financial infrastructure, privacy laws, and crucially, its favourable tax regime.

The inheritance tax proposed by the Young Socialists Switzerland political party targets precisely the segment that Switzerland currently serves best: the ultra-wealthy. While just 3.5% of all HNW expats reside in Switzerland, the share is nearly five times higher (17.1%) among billionaires. In contrast, only 2% of those that hold $1m to $4.9m in assets reside there. This skew towards those in higher wealth bands is set to change should the referendum pass.

Monaco, Singapore, Hong Kong (China SAR) stand to gain

Jurisdictions such as Monaco, Hong Kong (China SAR), and Singapore—already popular among the wealthy—stand to benefit. Monaco, for instance, hosts 5.36% of global billionaire expats despite being a fraction of Switzerland’s size, offering a zero-income and zero-inheritance tax regime. Hong Kong (China SAR) and Singapore, with 12.1% and 3.9% of global billionaire expats respectively, are also likely to see inbound shifts should Switzerland introduce more aggressive tax policies.

Private banks and wealth managers operating in Switzerland are already under pressure from global transparency initiatives and shifting regulatory tides. An inheritance tax of this magnitude would not only drive existing UHNW clients to reassess their domicile but could also dissuade new wealth from relocating to Switzerland altogether.

This is more than a tax policy change—it is a brand risk for the Swiss wealth management industry. Wealth managers may need to recalibrate their offerings or expand into more favourable jurisdictions to retain client trust and capture new flows.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataSwitzerland’s strength has always been its stability, discretion, and predictability. A sharp departure from these principles, especially in a way that targets the very base of its HNW appeal, could trigger a flight of capital and clients. In the face of rising global competition for mobile wealth, Swiss policymakers must carefully weigh the societal benefits of taxation against the long-term damage to a key pillar of the national economy. If preserving Switzerland’s wealth hub status is a priority, this proposal may need serious rethinking.

Heike van den Hoevel is Principal Analyst, Wealth Management at GlobalData