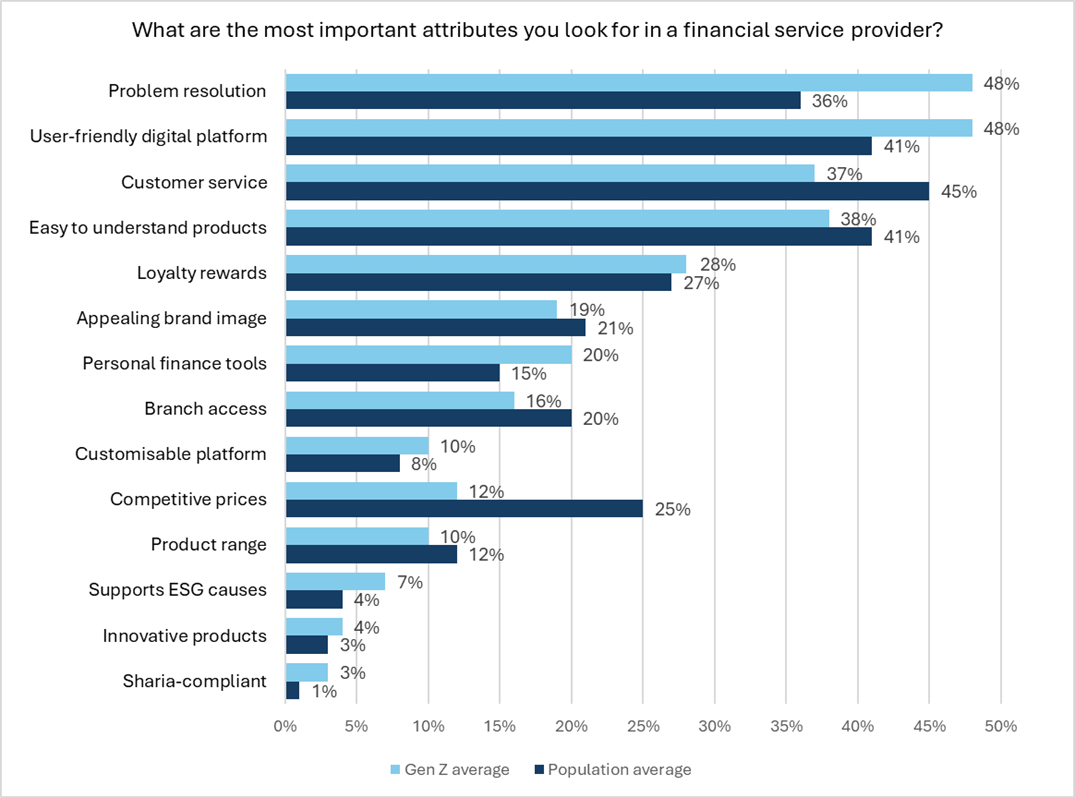

Lloyds Bank has launched a new student current account aimed at attracting younger customers in the UK, offering a £100 ($135) cash incentive, £90 in Deliveroo vouchers, and an interest-free arranged overdraft of up to £1,500, subject to application and eligibility. This initiative positions Lloyds alongside other major UK banks in the increasingly competitive race to win over Gen Z account holders ahead of the new academic year. However, cash incentives and food vouchers may not be sufficient for Lloyds to win the race, as GlobalData’s Consumer Profile Analytics 2024 suggests that the majority of UK Gen Z consumers are choosing their financial services provider based on problem resolution and digital user experience.

Although only 28% of UK Gen Z have taken loyalty rewards into account for their financial provider selection, the addition of Deliveroo vouchers is a notable effort to appeal directly to students’ spending habits and lifestyle preferences. With food delivery services and convenience purchases being common among university students, these incentives are strategically designed to offer immediate value. But while these incentives may play a role, Lloyds must also demonstrate strength in customer service quality and digital offerings to effectively compete for these new young customers, as the bank is far from alone in targeting the student demographic.

Competing banks are offering comparable packages. NatWest, for example, provides a student account with £85 in cash and a Tastecard valid for four years, worth £80 annually. Meanwhile, Nationwide is offering £100 in cash plus £120 in Just Eat vouchers. With such similar offerings across the market, Lloyds’s new account lacks strong differentiation. Its features, while useful, do not set it meaningfully apart from what is already available in the market.

GlobalData Consumer Profile Analytics 2024

Additionally, GlobalData’s Consumer Profile Analytics 2024 reveals that UK consumers prefer to take new financial products from their main current account provider. “I was already a customer” is the most selected reason for credit card and savings provider choice in the country. Against this context, Lloyds’s push to bring students to set up accounts early on takes on greater long-term significance. Successfully onboarding students now could lead to a deeper customer relationship in the years ahead, as young adults take out credit cards and set up savings accounts.

In short, Lloyds is in the race, but it is far from a guaranteed frontrunner. As UK banks compete for the attention of younger customers, particularly those entering higher education, the effectiveness of these incentive-based strategies will likely depend on how well banks can pair short-term benefits with long-term service. While Lloyds remains in the competition for younger customers, the lack of unique or standout features means its success may be modest and limited.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData