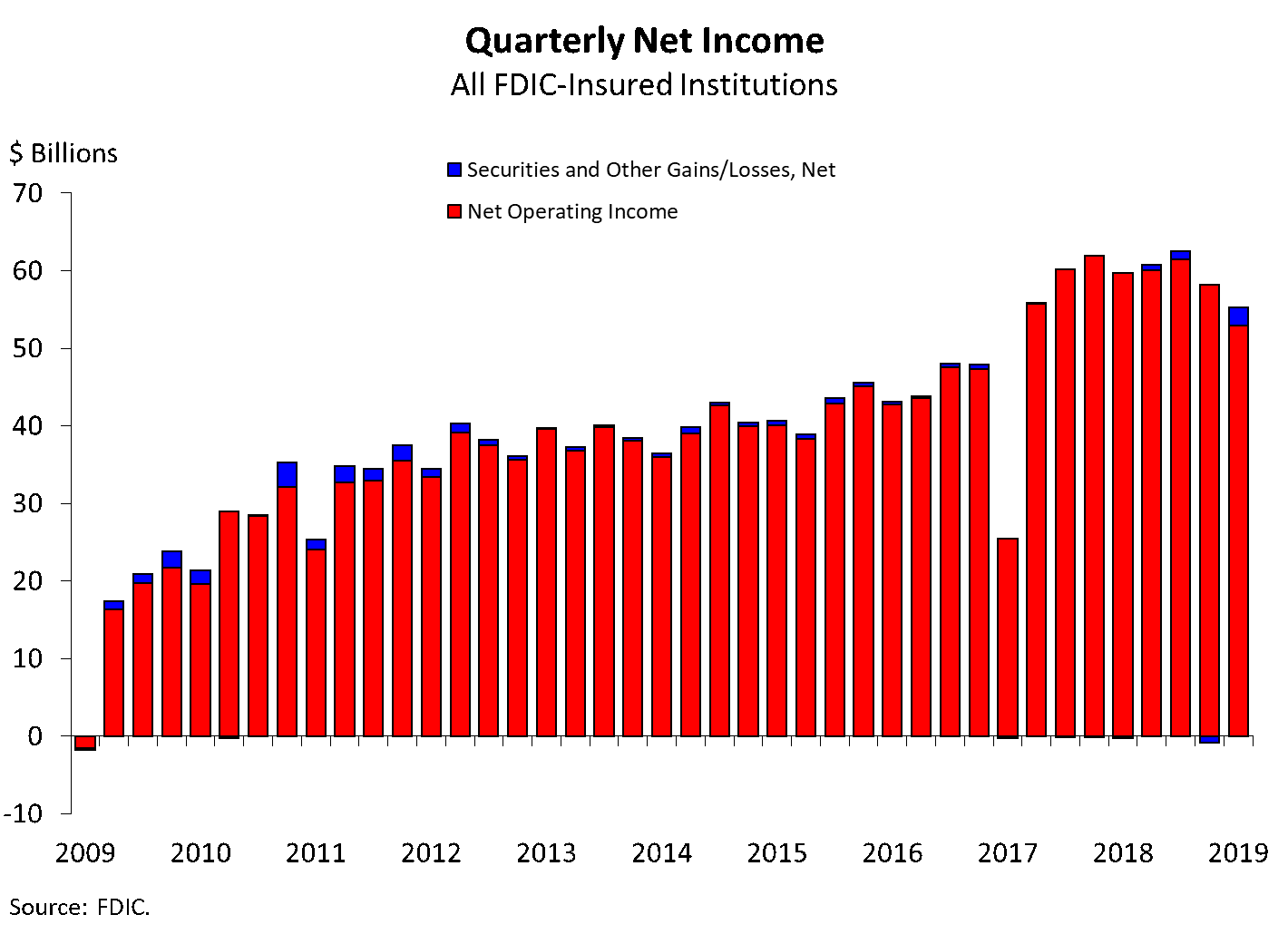

Fiscal 2019 goes down in the record books as the second most profitable year ever for US banks.

In total, US banks report net income of $233.1bn in 2019, down by 1.5% from the record year of 2018.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

Lower non-interest income also contributes to the trend. The average return on assets declines from 1.35% in 2018 to 1.29% in 2019.

But fourth quarter net income fell more sharply. In Q4, US banks net income totals $55.2bn, down by 6.9% year-over-year.

The quarterly decline in net income is led by lower net interest income coupled with higher non-interest expenses. The decline is broad-based, as nearly half (45.6%) of all institutions report annual declines in net income. The share of unprofitable institutions remains stable from a year ago at 7.2%.

The average return on assets ratio declines from 1.33% in fourth quarter 2018 to 1.20% in fourth quarter 2019.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataUS banks fiscal 2019: net interest margin -20bps

Furthermore, ongoing margin pressure is highlighted by a fall in the average net interest margins.

Specifically, NIM declines by 20 basis points from a year ago to 3.28%.

Net interest income falls by 2.4% from a year ago. This is the first annual decline since third quarter of 2013.

The sector totals relate to the 5,177 commercial banks and savings institutions insured by the FDIC.

The decline in net income is led by lower net interest income and higher expenses.

Other positives include a 14-year low for banks listed on the FDIC’s list of ‘problem banks. That falls from 55 to 51 so-called problem banks, the lowest number since 2006.

Moreover, the total assets of problem banks declines from $48.8bn in the third quarter to $46.2bn.

“The banking industry reported strong results, despite declines in full–year and quarterly net income. In the current economic environment, the FDIC encourages banks to maintain careful underwriting standards and prudent risk management,” says FDIC chair Jelena McWilliams.