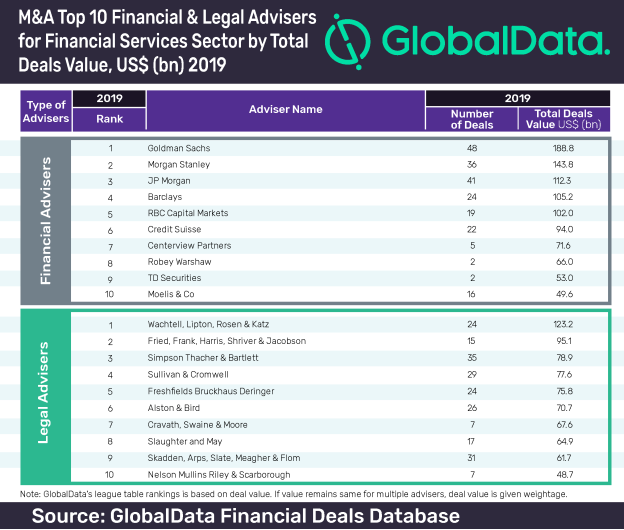

Goldman Sachs has topped the latest mergers and acquisitions (M&A) league table of the top ten financial advisers in the financial services sector in 2019, according to GlobalData.

The US-based multinational investment bank secured the top spot with 48 deals worth $188.8bn.

It figured in the first position in the GlobalData’s global league table of top 20 M&A financial advisers for 2019.

GlobalData has published a top ten of financial advisers ranked according to the value of announced M&A deals globally. If value remains the same for multiple advisers, deal volume is given weightage.

Morgan Stanley and JP Morgan came in second and third positions, advising on deals worth a total of $143.8bn and $112.3bn, respectively.

Ravi Tokala, Financial Deals Analyst at GlobalData, says: “The financial services sector recorded six megadeals (>US$10bn) and ~70 deals with more than US$1bn value. This resulted in over 10% jump in the year-on-year overall deal value in 2019. Five financial advisers and one legal adviser were able to cross the US$100bn mark. Goldman Sachs emerged as the top financial adviser in the sector, mainly driven by its involvement in five out of six megadeals recorded.”

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataDouble digit percentage increase in financial services deal value

The financial services sector saw an increase of 10.21% in deal value from $389.8bn in 2018 to $429.7bn in Q1-Q3 2019. Deal volume grew by 24.27% from 3,676 to 4,568.

US-based Wachtell, Lipton, Rosen & Katz led the top ten legal advisers table for 2019 with a value of $123.2bn through 24 deals. Fried, Frank, Harris, Shriver & Jacobson stood at second place with $95.1bn through 15 deals. In the global league table of top 20 M&A legal advisers, Wachtell, Lipton, Rosen & Katz was ranked first.

GlobalData’s league tables are based on the real-time tracking of thousands of company websites, advisory firm websites and other reliable sources available on the secondary domain. A dedicated team of analysts monitors all these sources to gather in-depth details for each deal, including adviser names.

To ensure further robustness to the data, the company also seeks submissions from leading advisers, through adviser submission forms on GlobalData’s website