Heading off to University? You’ll need a bank account; so which bank is best for students in the UK?

It’s not often top of the list for prospective students however, choosing a bank account for University will have a long lasting effect as more than often, consumers stick with the same bank.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

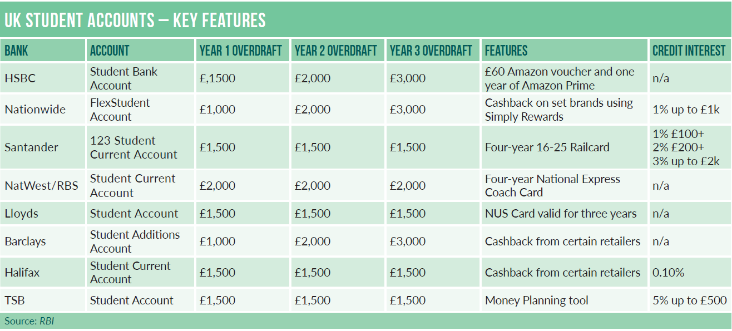

From competitive overdraft rates to gift vouchers and travel discounts major UK banks and digital challengers have a range of incentives designed to tempt school leavers to open student current accounts.

For many students this will be the time first dealing with a financial institution, and while it may not exactly be an exciting task it’s one well worth getting right.

Which bank is best for students UK: attractive overdrafts

For students the thought of an overdraft scares them. However, student bank accounts often offer a guaranteed 0% interest overdraft.

Due to this, it can be quite tricky to pick which bank is best for students in the UK in terms of overdrafts.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataEach bank surveyed in the table varies in its limits, fees and changes to that overdraft.

HSBC offers a competitive overdraft with up to £1,000 in the first year with no overdraft fee. This amount again increases per year to £2,000 in year two and £3,000 in year three. However HSBC does not guarantee the maximum amount; the amount a student receives will be judged on their credit score account activity.

In year 4+, on completing your course HSBC will move students onto its Graduate account. Students might be eligible for an overdraft facility, of which £1,500 will be interest-free during the first year and £1,000 in the second year after graduation (subject to status and account conduct).

Lloyds and Santander both have the same overdraft amounts offered as part of their student accounts. The two banks offer up to £1,500 from year one to year three, and if students continue their studies they can apply for an increase depending on their credit score; if the credit score is healthy then Santander can offer up to £1,500.

Although Monzo and Starling have great and attractive mobile apps, they don’t currently offer interest-free overdrafts.

Monzo customers can opt in to an overdraft that will cost 50p each day that an account is overdrawn, and Monzo has stated that it will never charge a customer more than £15.50 a month.

Therefore, at the moment, the challengers may not be the best pick if an overdraft is the key attraction. Furthermore, in February 2019, the UK student survey found that the incumbent banks are racing ahead of the challengers when it comes to marketing to the student population.

The freebies

The most eye-catching of all the incentives are the freebies that UK banks offer. These range from Amazon vouchers to Railcards and to cashback offers

Cashback offers are another perk that entices students. Some high street banks offer students discounts of up to 15% with numerous different brands.

Both Nationwide and Barclays match cashback offers with purchasing history. Therefore, students are more likely to be offered discounts that will actually be useful. Lloyds will provide students with a free NUS card that is valid for three years. This deal can deliver up to 15% cashback with Everyday Offers.

One of most practical and money-saving incentives offered is the 16-25 Railcard provided by Santander, that lasts four years. Students can enjoy a third off all standard anytime, off-peak and first class advanced tickets. A 16-25 Railcard costs £30 a year, so in total this giveaway is worth £120.

Banks now embrace innovative technology to offer the most alluring products. With so many incentives out there, it wise for students to take the time to pick out which one suits them the most for the duration of their studies and beyond.