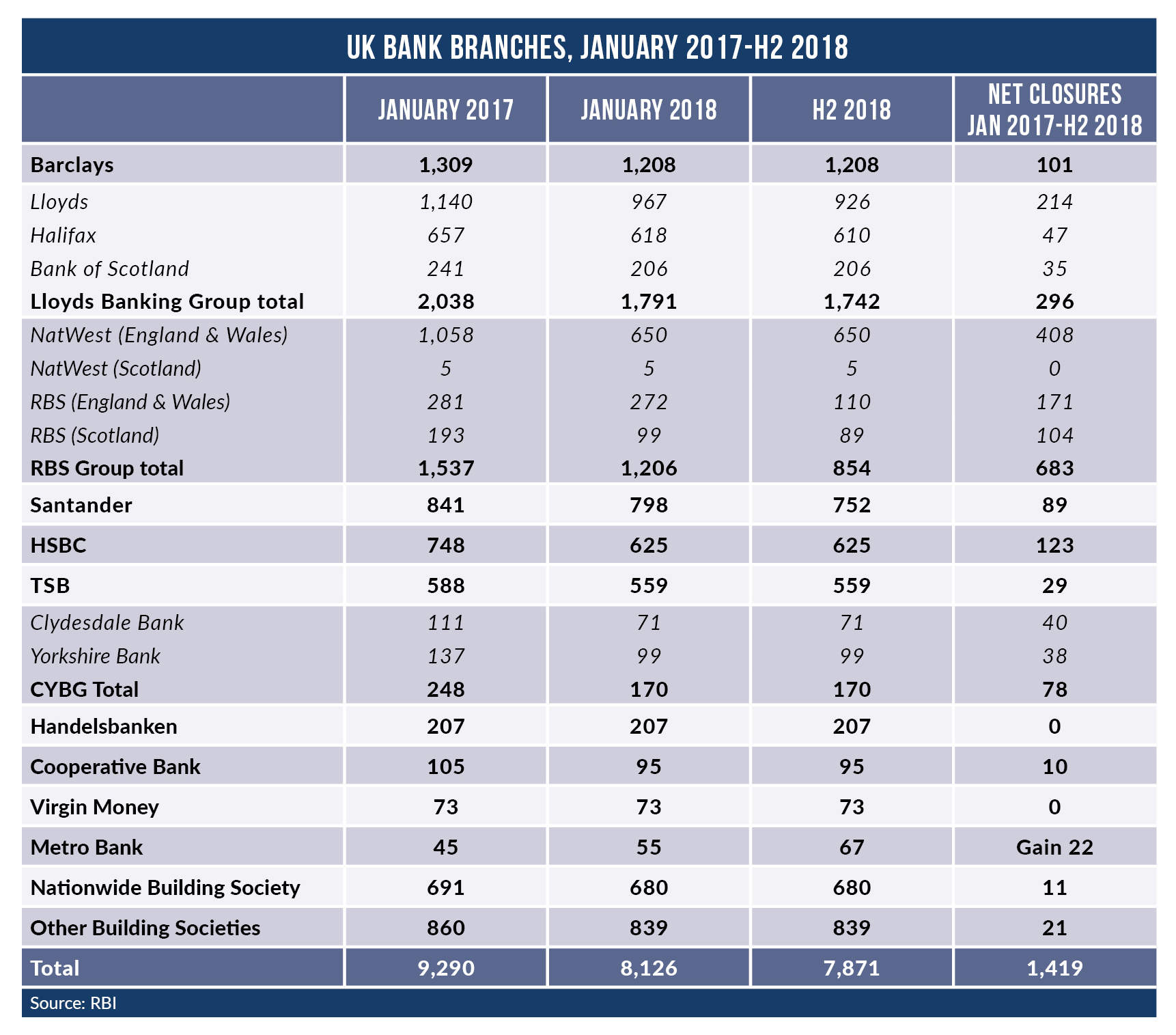

Further branch closure programmes announced in the second quarter by Santander, Lloyds and RBS will bring total UK bank and building society branches to below 8,000.

Since the start of 2017, more than 1,400 branch closures have been announced, 15% of the then sector total.

Royal Bank of Scotland/NatWest account for almost one-half of the closures announced in the past 16 months with 683 outlets set to close.

When all of the latest announced closures take effect, the UK’s 66.5 million population will have a branch penetration rate of less than 12 branches per 100,000, the third lowest rate in Europe.

Only in the Netherlands, with 1,600 branches serving 17 million people (a branch density of 9.4 branches per 100,000) and Estonia 99 branches for 1.3 million (density rate of 7.6) is the rate lower than the UK.

At the other end of the scale Spain (61), France (55) and Italy (48) remain over-branched.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataGermany’s 83 million population is served by a branch network of around 27,000 branches, a branch density of around 32.5 branches per 100,000 people, down significantly from 38 since 2013.

According to estimates from Bloomberg, the number of German savings bank branches fell by 7% to 9,868 in 2017 while cooperative banks closed 5.8% of its branches to reduce its network to 11,108.

The European average is around 35 branches per 100,000.

Even Denmark and Sweden, with around 15 branches per 100,000 have more branches per head of population than the UK.

In the US, total branch numbers peaked as recently as 2012 with a then sector total of 83,576.

Since then, only a net 4,400 branches have closed; the US ended 2017 with a total branches network of 79,173 serving its 326 million population, a branch density of 25 branches per 100,000.