Current account switching rates in the UK have inched up for the quarter to end March. A total of 273,470 switches were completed in the first three months of 2018, the highest quarterly total since the first quarter of 2016 and an increase of 10% compared to the corresponding period last year.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

Total switches in 2017 amounted to 931,956, down a whopping 8% from 1,010,423 in 2016. Even worse: the rate of decline in total switches increased. The figure for 2016 represented a decline of 2.3% from the 1,033,939 switches in 2015. In 2014, there were 1,156,838 switches.

Winners and losers: Halifax and Nationwide lead the way

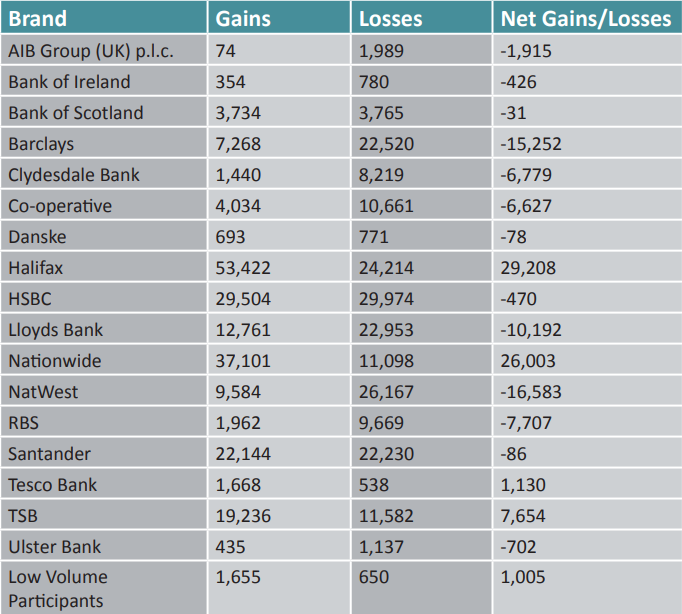

Figures are also out for switching rates by brand; this data is released six months in arrears so the undernoted figures relate to switches complete between 1 July and 30 September 2017.

Once again, Nationwide has performed strongly with a net 26,000 gains but is trumped in Q317 by Halifax with over 29,000 gains.

RBS and English retail subsidiary NatWest combined lost over 24,000, ahead of Barclays with a net 15,000 losses.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData