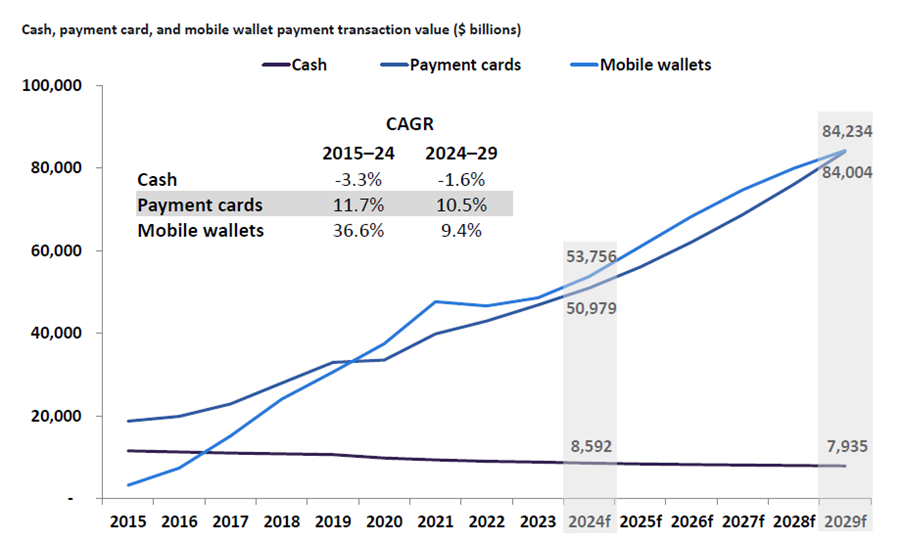

As the world moves away from cash, the entire payments ecosystem is becoming more interlinked. Digital payments by card and mobile wallets are soaring in line with the e-commerce boom. According to GlobalData analytics, they now also represent nine out of ten in-store transactions by value, a share that is set to rise even further as smartphones become ubiquitous.

But, with global payment card fraud losses estimated at around $22bn in 2024, and fraudsters becoming more sophisticated all the time, the need to adapt is urgent. In a world where mobile wallets and digital payments predominate, authentication has become the front line of fraud control. For three decades, the industry’s answer has been to add layers: from signatures to chip-and-PIN, one-time passwords and device-based confirmation. Banks and fintechs are adding to a wave of innovation in the form of contactless, QR, buy-now-pay-later – and, increasingly, biometrics at the point of sale, both digitally and physically.

Biometrics are having a major moment. In GlobalData’s 2024 Financial Services Consumer Survey, 86% of respondents globally said they always or sometimes use biometric features on their payment platforms. The use of fingerprints and facial recognition to unlock phones has ingrained habits that easily extend into approvals for payments.

Now both policymakers and businesses are placing big bets on biometrics. The EU’s Digital Identity Wallet programme is running large-scale pilots across dozens of countries, extending the use of wallets from finance to everyday scenarios such as banking, travel tickets and retail payments. It could be rolled out across the continent by the end of 2026, and biometrics will be core to its functionality. In Asia, Ant International has added iris recognition to its Alipay+ GlassPay smart-glasses solution, combining iris pattern and voiceprint checks to secure hands-free payments in augmented-reality environments. As the boundaries of biometrics are pushed ever further forward, payment brands cannot afford to waver.

The Biometric Moment

Several streams are feeding into the current flood of biometric pilots. First is the maturing of biometric technology itself. Card schemes, processors and specialist vendors have brought fingerprint sensors onto cards and into consumer devices. For example Thales, a technology company, has deployed biometric payment cards in markets from Cyprus and Lebanon to the UK and Switzerland, with fingerprints captured and stored securely on the card rather than in a central database. Life Card in Japan is preparing a similar launch; traditionally a more cash-reliant market, it reflects how secure, biometric-forward card penetration is set to expand.

Second is a growing appreciation that not all biometrics are equal at the till. For example, the pandemic highlighted the drawbacks of touch-based readers in public spaces. Faces and fingers are at the core of biometric identification, and unlikely to go anywhere – but pilots are taking the technology down new avenues. Palm recognition, for instance, allows shoppers to simply hold a hand over a reader in a motion that feels similar to tapping a card or phone. Amazon One links a shopper’s palm to a payment method and is now live beyond Amazon Go stores, including in supermarkets and venues, and Mastercard is piloting pay-by-palm in Uruguay, explicitly targeting in-store queues. Mastercard has also debuted a biometric card, embedding a fingerprint sensor directly into the plastic; it verifies the user locally and then sends a tokenised transaction into the usual card rails, removing the need for a PIN while keeping biometrics off merchant systems. As brands become more adept at subtly integrating biometrics into their customers’ lives, their spread will only ramp up.

All of this sits atop a broader shift in fraud and security. Tokenisation now replaces primary card numbers with single-use tokens across mobile wallets and contactless payments, shrinking the value of intercepted data. Strong customer authentication increasingly uses several checks – device, behaviour and biometrics – combined with AI-based risk scoring. Biometric technology has cemented itself as a visible and indispensable part of a multi-layered security fabric, one that payment brands need and customers demand in the fraud fightback.

What Now for Issuers and Acquirers?

For issuers and acquirers, the question is no longer whether biometric payments will grow. They need to act now, following the direction set by market leaders. That means working through how best to harness biometrics without upsetting customers or falling foul of regulators. Disciplined pilots, careful measurement and a clear view of where biometrics genuinely improves the in-store experience are vital.

The most compelling early use cases share two traits: high frequency and high impatience. Grocery chains, quick-service restaurants, public transport and large tourist venues stand out. Here, mainstream facial and fingerprint-based biometric payments are already in common currency. But these are also environments where Tencent’s palm trials, Amazon One’s expansion and Mastercard’s Uruguay pilot are compressing queues still further by securely and speedily simplifying payment processes. Issuers and acquirers can work with merchants to test biometrics in real-world conditions, starting with low-ticket transactions where the risk is manageable and the value of speed is obvious.

Clear metrics are essential. Conversion is the first: what share of attempted transactions fail or are abandoned under today’s process, and how does that change once biometric authentication is available? Queue length and average checkout time are the second, particularly in supermarkets and fast-food outlets. Fraud and chargebacks are the third: does biometric authentication reduce unauthorised use or simply migrate it into account-takeover and social-engineering scams? Taken together, these can cut through the industry buzz and provide clear direction on whether customers embrace new methods or quietly fall back to card and cash.

Privacy and data governance sit alongside these commercial metrics. Biometric-forward payment approaches, without sufficient guardrails, may actually be more susceptible to cybercrime than traditional alternatives; GlobalData findings suggest 18.8% of mobile wallet users have experienced financial fraud in the past three years, compared with 17.5% of all consumers. European work on the Digital Identity Wallet stresses that identity and credential data should be stored and shared in ways that minimise disclosure and keep users in control. Many biometric payment schemes already mirror this approach: Mastercard’s and Thales’ biometric cards keep fingerprint templates on the card itself. Issuers and acquirers should favour such designs, where raw biometrics are encrypted and risk is minimised.

Another crucial criterion for design is resilience. When power failures in Spain earlier in 2025 caused widespread digital payment downtime, it showed why cash and ATMs still matter. With GlobalData’s 2024 Financial Services Consumer Survey finding 58% of consumers had withdrawn cash within the previous month – a share that has remained largely stable since the pandemic – customers must retain choice over how they pay, and terminals need graceful fallbacks should unexpected circumstances take this choice out of both consumer and issuer hands.

Issuers and acquirers rarely have the capacity to engineer all of this alone. Working with expert partners – card schemes, terminal manufacturers, biometric specialists and risk-analytics providers – helps on three fronts. It allows them to piggyback on existing tokenisation, dynamic CVV and AI-driven fraud tools rather than building their own from scratch. It opens access to multi-country rollouts and standards efforts. And it reduces integration pain for merchants, who need to be able handle cards, wallets, QR codes and biometrics – and their constantly evolving mix in the payment ecosystem – through one interface.

Issuers and acquirers that treat this as an opportunity to create faster, safer and more trustworthy in-store experiences – grounded in clear metrics, strong privacy and robust partnerships – have a strong basis for dominating biometric-era checkouts. With Mastercard Business Intelligence, firms of all sizes get access to powerful tools helping them stay competitive, make insight-driven decisions and thrive in a rapidly changing landscape. Log in with your Mastercard Connect credentials here to explore our full suite of business intelligence solutions. Or, if you don’t have access yet, request your credentials here today.