Standard Chartered has entered Hong Kong (China SAR)’s stablecoin sector as the SAR passes a law—the Stablecoins Ordinance—allowing licensed businesses to issue fiat-referenced tokens. Initially, only a limited number of licenses will be offered, providing Standard Chartered with an opportunity to capitalise on strong demand for crypto and shape client-facing infrastructure, pricing, and standards as an early licensee, even if uptake will build more slowly than in other hubs, such as the US.

The Stablecoins Ordinance, which came into effect on 1 August, turns the issuance of fiat-referenced stablecoins into a licensed activity with a focus on stability and institutional use cases. The regime is deliberately stringent; issuers must do full Know Your Customer/anti-money laundering reporting, verify the identity of every token holder, and abide by redemption/reserve rules, but long run this will build trust in the market.

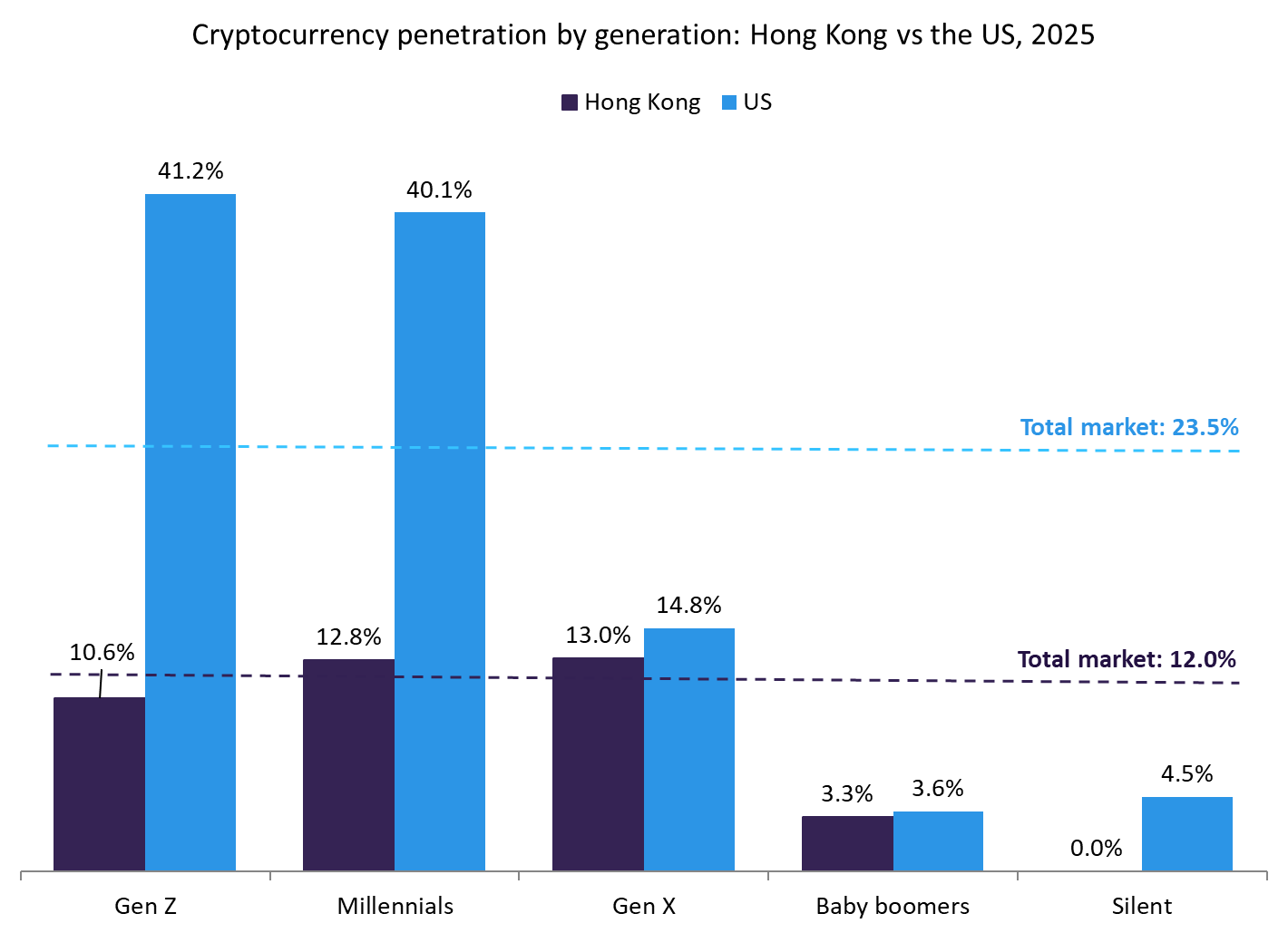

Crypto penetration: Hong Kong v the US

Even before the law, retail demand exists, 12% of Hong Kong (China SAR) residents already hold a cryptocurrency. This pales compared to 24% in the US, which has been much more laissez-faire. However, a more gradual, and regulated approach will pay off in the long term even if the US’s uptake will outpace Hong Kong (China SAR)’s thanks to ongoing federal momentum in the States.

Source: GlobalData’s 2025 Financial Services Consumer Survey

That does not diminish the opportunity in Hong Kong (China SAR). In the US, crypto uptake heavily skews towards younger, often less experienced investors. Penetration rates among Gen Z and millennials are 41% and 40%, respectively. Given the high volatility of crypto—even of so-called stablecoins—an overly eager but inexperienced investor base chasing shiny yields is set to get burned if a stablecoin slips its peg or gets frozen and potentially jump ship.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataHong Kong (China SAR)’s more gradual approach, reserves and redemption requirements, and closer oversight thanks to fewer licensees all mean greater investor protection and ultimately a more sustainable, even if less pronounced market growth.

For Standard’s Chartered, the opportunities lie in targeting an eager but often inexperienced, albeit desirable, demographic with education-led ‘stable-cash’ offerings before competitors can build up a strong client base that is less likely to churn when markets turn or rivals dangle slightly higher yields.

Heike van den Hoevel is Principal Analyst, Wealth Management, GlobalData