UK fintech Countingup rolls out a tax estimate tool to ease the annual tax burden for its users.

In particular, the tax estimate tool is Countingup’s latest initiative to bring the worlds of banking, accounting and tax one step closer. Furthermore, the launch is timely with the self assessment tax deadline fast approaching. Specifically, around three million UK tax returns remain unfiled according to HMRC.

HMRC say that five million tax returns were outstanding at the beginning of January, highlighting how busy month January is. Countingup CEO Tim Fouracre says: “January is a painful time of year for small businesses and accountants. Not only is there pressure to get tax returns submitted but there’s the cashflow hit to pay the tax.

“For small businesses with the shoe-box of receipts and spreadsheets, the pressure is only going to get worse. In particular, when Making Tax Digital will require four quarterly tax returns every year.

Countingup tax estimate tool: built into its current account

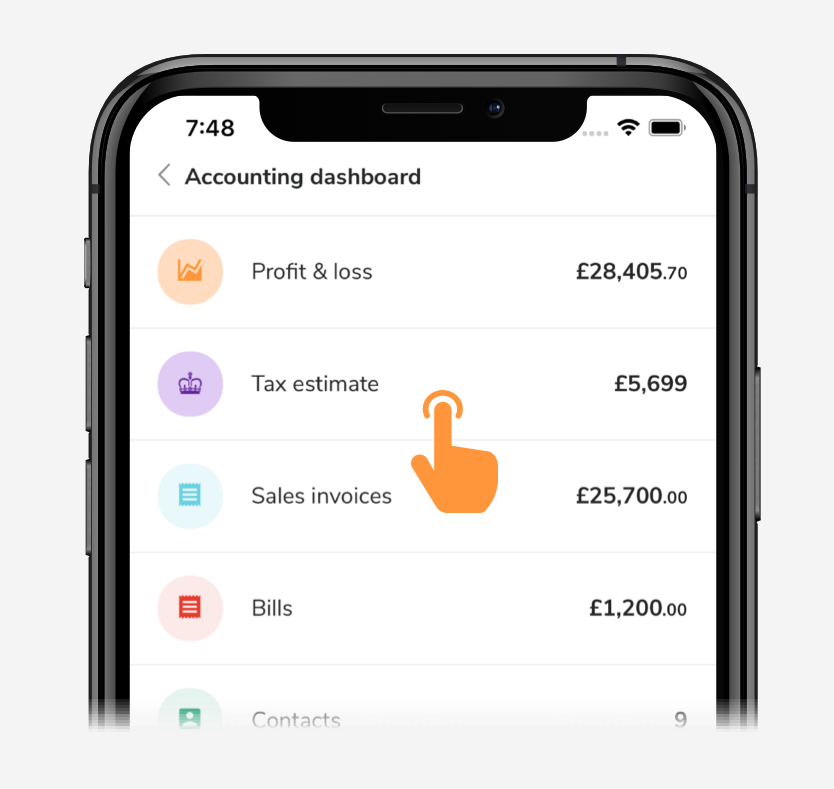

The Countingup tax estimate tool is built into its business current account. It joins a suite of accounting features including invoicing, expense capture and profit and loss reporting. For self-employed sole traders, the tool provides a real-time estimate of how much Income Tax and National Insurance is owed under Self-Assessment.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataFor limited companies, the tool provides a real-time estimate of how much Corporation Tax is owed. Fouracre adds: “Our tax tool means no more tax surprises for small businesses. Inside their Countingup business current account, our customers have insight into how much their tax bill is likely to be at any point in the year.”

The Countingup tax estimate tool represents a first from a business current account provider. Fouracre says that high street banks see the tax season as an opportunity to sell expensive loans to small business owners who have had a nasty surprise when they find out their tax bill.

“We want to prevent that from happening.” The Countingup app is primarily targeted at micro businesses: from freelancers to plumbers to gig economy workers. There are 4.3 million businesses in the UK that are just one person, which is nearly 90% of all businesses. Countingup is not only a business current account; it’s accounting software too. As well as tax estimates, invoicing and automated bookkeeping, SMEs get a sort code, account number and Mastercard, all from Countingup, in one app.

To date Countingup has signed up over 20,000 businesses since its September 2017 launch.